Preparing and filing your personal income tax return can be overwhelming, especially for individuals and small business owners. The good news is that this process can become smoother and more efficient with the right information and planning. With this article, we aim to provide you with the essential items needed to prepare your tax return, ensuring that you don’t overlook any important details that could be costly in the long run.

Obtain All W-2s for Employment Income

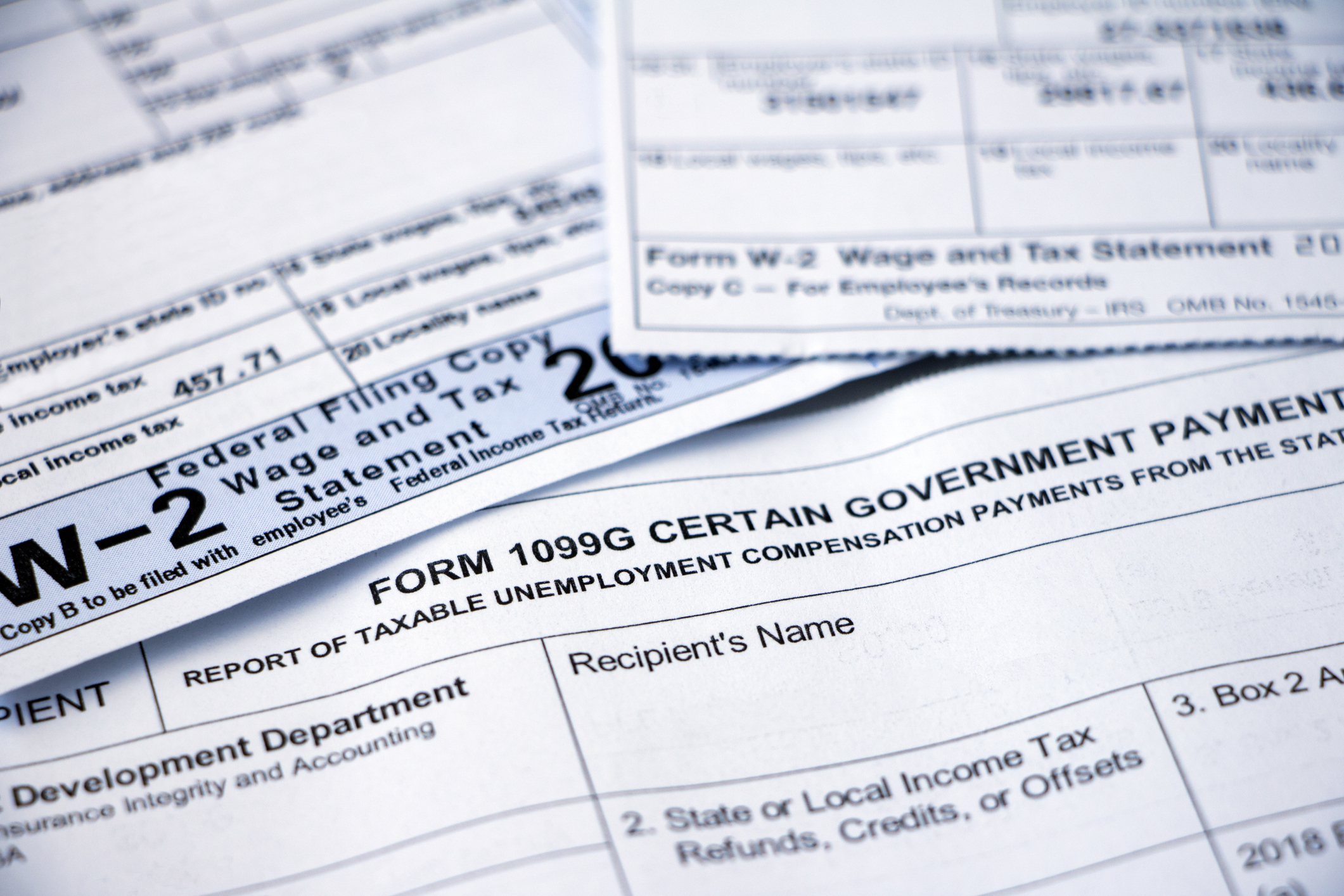

One of the first things you must prepare is to gather your W-2 forms. These forms serve as annual wage and tax statements provided by your employer, presenting crucial information such as your earned income, tax withholdings, Social Security and Medicare deductions, and other relevant benefits. Having all W-2s related to your employment income for the filing year is imperative to avoid discrepancies in your return.

Include all K-1s For S-Corps and Partnerships

If you are a partner or shareholder in a business, you should receive a K-1 form. This form includes information on your share of the business’s profits, losses, and deductions. These details must be included in the personal income tax return.

However, it’s worth noting that W-2 and K-1 forms can be complex and require careful review and analysis. If you find yourself unfamiliar with the process, we highly recommend the assistance of a knowledgeable accountant.

Include Your Social Security Income (SSA 1099)

Social Security income, also known as Old-Age, Survivor, and Disability Insurance (OASDI), is subject to taxation and should be included in your personal income tax return. You can obtain a copy of your SSA 1099 form, which outlines your Social Security income for the year, through the Social Security Administration’s online platform. Make sure to review the statement for any errors, as it’s essential to file accurate returns to avoid any penalties.

Don’t Forget Any 1099s for Interest, Dividend Income, or Stock/Bond Transactions

All 1099 forms issued for interest income, dividend income, or stock/bond transactions must be included in your personal income tax return. Be sure to gather all forms for review, as well as any documentation that supports the returns, such as trade confirmations or monthly bank statements.

Include Any Other Forms of Income

To ensure compliance with tax regulations, ensure that all sources of income, including but not limited to rental income, contracts, consultations, and other compensations for services, are accurately reported on your tax return. Failure to include these sources of income may lead to penalties and interest, so it’s important to maintain transparency and disclose all relevant information.

Gather All Medical, Hospital, and Insurance Expenses

Medical expenses incurred throughout the year, including payments to hospitals, physicians, insurance premiums, and pharmacy expenses, are deductible from taxes. To accurately report the deduction amount, make sure to collect all bills and receipts diligently. Since the IRS has specific rules, work with a tax professional to ensure compliance.

Report All Mortgage Interests and Real Estate Taxes

If you are a homeowner, you have the benefit of deducting mortgage interest and real estate taxes paid on your primary residence from your income tax returns. To support this deduction, use Form 1098 provided by your mortgage lender and any receipts for property taxes paid.

Document All Donations, Cash, and Gifts of Tangible Property

If you donated cash or gift items to charitable institutions, be sure to report them on your personal income tax return. These donations can result in valuable deductions, and you can include the value of the donated items and any money spent on charity. Be sure to keep any canceled checks, receipts, or bank statements that prove your contributions.

Your Trusted Partner For Personal Income Tax Return Reports

Preparing and filing your personal income tax return can be made more comfortable by ensuring you have all the necessary items to complete the process. Make sure to gather all the items required for completion. These include the necessary W-2, K-1, SSA 1099, 1099, and any other relevant forms of compensation. Don’t forget to document any medical or insurance expenses, mortgage interests, taxes, and charitable donations.

To facilitate this process and achieve the maximum possible deductions, entrusting your financial matters to a professional accountant is highly recommended. By collaborating with KDK Accountancy in Orlando FL, you are guaranteed the expertise and knowledge necessary to grow and enhance your business. For a complimentary consultation, we invite you to reach out to us at (407) 759-5363 or visit our website.