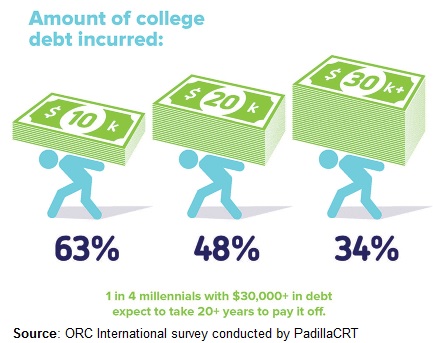

If you’re sitting on a huge pile of student debt and think your loan interest deduction will save you loads on taxes, think again.

That because borrowers are permitted to deduct only a portion of the interest they’ve paid on educational debt. And it phases out if you make too much.

As long as you’ve paid at least $600 in student loan interest you will get a Form 1098-E from your lender or the firm servicing your debt that you can use to claim the deduction at tax time.

The trouble is the benefits aren’t as widespread as borrowers may believe — and they aren’t very helpful if you have a lot of debt or are earning too much money.

“You get these forms from your lender, and then you find out you can’t deduct the interest,” said Gavin Morrissey, managing partner at Financial Strategy Associates in Needham, Massachusetts. “That happens with a lot of people.”

Here’s why the student loan interest deduction is less of a “give-me” than you think it is.

How it works

The student loan interest deduction allows you to lower your taxable income by up to $2,500. In order to qualify, your loan must have been made solely to cover qualified educational expenses.

Note that this is an “above-the-line” deduction on your Form 1040. This means you do not need to itemize your deductions to claim it. The deduction is limited to you, your spouse or your dependent.

Read more of this article on CNBS: http://cnb.cx/2rgd7ms