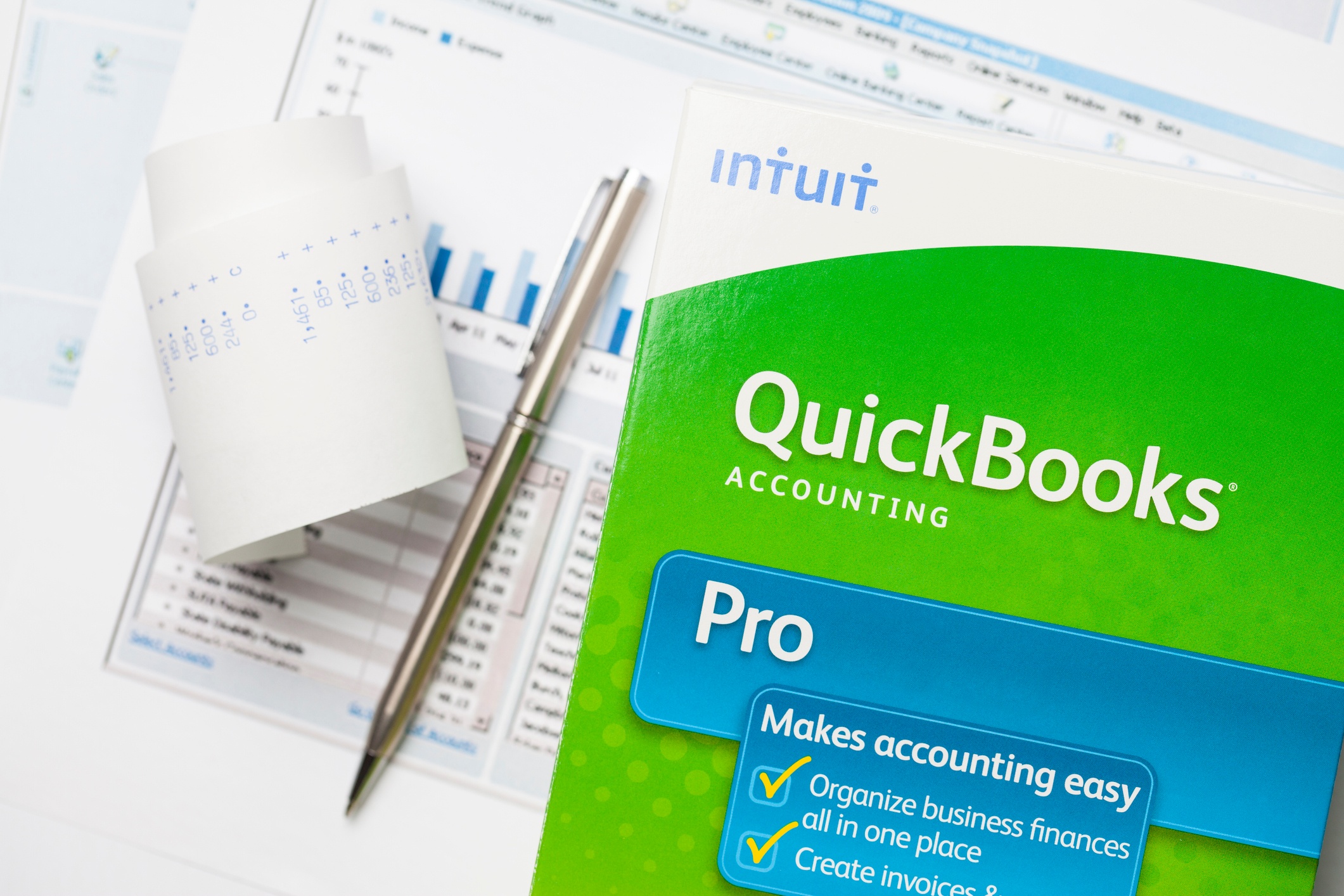

As a small business owner, you probably want to minimize costs wherever you can. Other people might have advised you to save your money when it comes to using accounting software and do all of your recordkeeping manually. If you have a background in accounting and lots of spare time on your hands, that’s not a bad solution. If you’re in a similar situation to other small business owners, though, professional software such as Quickbooks can give you a huge advantage when it comes to streamlining your small business accounting. Read on to find out how.

Get Started Right Away

Quickbooks is easy to install and set up, which means you can get started with organizing your accounting needs right away. Instead of spending your time creating a master Xcel file or mapping out your business’s Google Sheets to use as invoices and for tracking expenses, you can sign up with Quickbooks and have all the tools you need to run your business at your fingertips.

It’s important to note that you’ll still need to input the correct information into Quickbooks at the beginning so that you don’t see errors proliferate as you add expenses, invoices, and more. Quickbooks setup is fast and relatively straightforward, but you can always bring on a professional Quickbooks advisor to make sure you don’t miss anything.

Make Fewer Mistakes

Small business owners make fewer mistakes when using Quickbooks accounting software. Accounting mistakes can cost you time and money, taking you away from the more pressing issues of running your business. Manual accounting used to be the only solution for business owners, but digital innovations can help you catch mistakes before they happen so that you can spend time on more important matters.

Keep Critical Information Organized

Quickbooks can make it so that all of your critical information is organized in one central place that is easy to access and easy to search. Staying organized will save you time each and every day. You won’t have to hop from one application to the next to do tasks such as creating an invoice, exporting a report, and managing your cash flow. Quickbooks makes it easier for you to stay on top of your finances without overlooking any of the critical details.

Rely on Cloud-Computing

Quickbooks software is now available via the cloud, which means you can access some of the functions you use every day from anywhere on any device as long as you have an internet connection. This can give your business a huge efficiency boost, especially if you regularly work outside of a traditional office setting.

Stay Tax-Ready All Year

Getting ready for tax season can be a challenge for small business owners, but with the help of a Certified QuickBooks Pro Advisor like KDK Accountancy, you can stay prepared all year round. QuickBooks can keep your tax information organized and easily accessible, so you won’t have to scramble to get your reports ready when tax season arrives. KDK Accountancy can help set up QuickBooks for your business and provide ongoing advice, support, and guidance throughout the year. Don’t let tax season catch you off guard—call KDK Accountancy today to get started at 407-759-5363.